Goods and Service Tax is the biggest reform in the structure of Indirect Tax in India since the market began unlocking 25 years back. This website belongs to GTRZ.

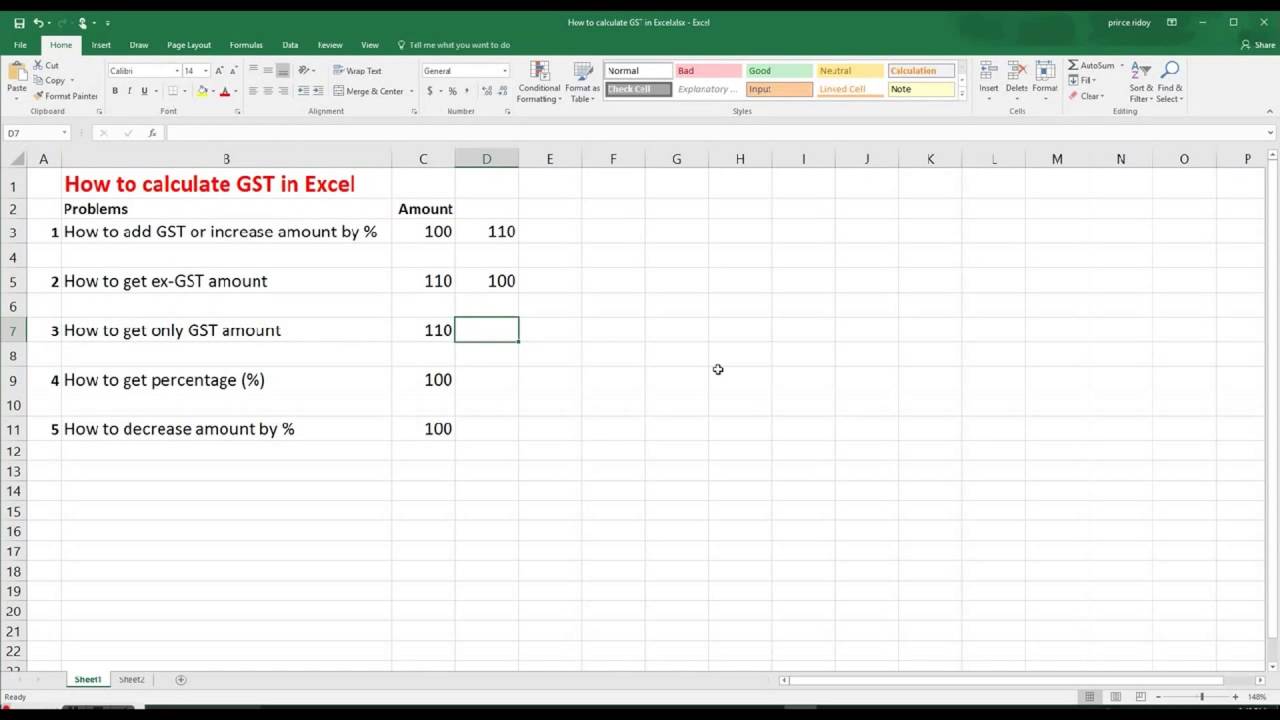

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

The GST is imposed on the value-added services and goods at every stage of consumption in the supply chain.

. Join millions of people using Oodle to find unique used cars for saleCheap cars for sale under 2000 Cheap cars for sale under 1000 Year Older Cars Newer. Where the unrounded. The overtime rate payable is capped at 2250 to help Employers manage costs even though the salary threshold of non-workmen has been increased to 2500.

025 per annum on the highest gold balance recorded in your GSA in a calendar month. The new homeowner is required to get a new home. Prior to 20 Feb 2018 the top marginal BSD rate for both residential and non.

The goods and services tax is a consumption-based tax because it is chargeable where the consumption is taking place. Incentive An incentive on income tax is given for 5 years which is calculated based on a formula. Find cheap Commercial Property For Sale in Wolverhampton West Midlands on Loot.

Discover your ideal property or place an ad today. Once the property that has been insured is sold by the policyholder the said policyholder ceases to hold any more insurable interest in the policy. Or if all taxable sales on a tax invoice include an amount of GST exactly 111 of the price add up the GST-exclusive value of each taxable sale calculate GST on that amount and then round to the nearest cent rounding 05 cents upwards.

Monthly service charges on the GSA are payable. In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes. The monthly service charges are charged in grams of gold.

The service charge for GSA is the higher of. The copyright to the contents of this website is. Further the GST has replaced many indirect taxes such as excise duty value added tax VAT service tax etc.

012 grams of gold per month. The term GTRZ or us or we refers to Gideon Tan Razali Zaini the owner of the website whose registered office is 812 8th Floor Block A Kelana Square 17 Jalan SS726 47301 Petaling Jaya Selangor Darul Ehsan Malaysia. Buyers Stamp Duty BSD Additional Buyers Stamp Duty ABSD Sellers Stamp Duty SSD BSD is payable on the purchase or acquisition of properties.

MSC status companies that indulge in high capital. For offshore trading companies that are approved and are operated by non-residents of Malaysia by using a website in Malaysia for sale of foreign goods outside Malaysia an exemption is provided. It came into effect from July 1.

As a result the policy also ceases to be able to provide any protection to the policyholder. In other words resident and non-resident organisations doing business and generating taxable income in Malaysia will be taxed on income accrued in or derived from Malaysia. Electrical Mechanical Breakdown Damage due to short circuit as payable risks.

GST law applies as a single domestic indirect tax law for the entire country. Failure to stay compliant with the EA is considered an offence where employees who are not paid for work done can report their employers to Ministry of Manpower for investigation. Resident organisations carrying out.

Affwonn IRE Free Eagle IRE - Shaunas Princess IRE Racehorse Ownership Club. This 55 withholding tax will be considered as minimum tax and Corporate Tax is also applicable whichever is higher will be the tax liability on this business. Taxable sale rule work out the amount of GST for each individual taxable sale.

There are three types of duties payable on the sale purchase acquisition or disposal of properties in Singapore. GST or the goods and service tax is a comprehensive multi-stage and destination-based tax levied on every value addition. For example 55 withholding income tax is applicable on commercial imports and is payable at the import stage.

Training Modular Financial Modeling Ii Sales Taxes Financial Statements Cash Flow Statement Modano

Tax Intelligence Solution Gst Data Analytics Kpmg India

Training Modular Financial Modeling Ii Sales Taxes Gst Gst Rate Modano

Registering For Gst Video Guide Youtube

Training Modular Financial Modeling Ii Sales Taxes Financial Statements Cash Flow Statement Modano

Houz Depot Big Clearance Extended In Malaysia Furniture Promo Depot Extended

Training Modular Financial Modeling Ii Sales Taxes Gst Gst Rate Modano

Faqs Place Of Supply For Goods Under Gst

4 Mar 30 Jun 2016 Sunway Putra Hotel Power Lunch Buffet Free Parking Lunch Buffet Lunch Power Lunch

24 Jun 3 Jul 2016 Peekaboo Babyshop In House Fair Warehouse Clearance Sale Baby Shop Warehouse Clearance Sale

The Money Supply Measuring M1 M2 Datapost Teacher Resources Money Make More Money

Gst Impact On Construction Capital Costs Download Table

Training Modular Financial Modeling Ii Sales Taxes Gst Gst Rate Modano

How To Make Calculating Gst Easier

Non Resident Businesses Get Ready For Gst Hst Changes Kpmg Canada

What S New In The World Of Gst Tax Alert February 2021 Deloitte New Zealand

Training Modular Financial Modeling Ii Sales Taxes Financial Statements Cash Flow Statement Modano

Supreme Court S Landmark Gst Judgment Here S What Experts Have To Say Businesstoday